The Importance of Accurate Fuel Receipts for Tax Purposes

Fuel receipts are very important in dealing with business expenses. They offer evidence of fuel expenses and support the monitoring of expenses in the long run. For businesses, they are very useful documentation for tax deductions. Fuel is another area that becomes almost impossible to justify if there are no receipts to support the fuel receipts.

Although this process may appear to be simple, it is imperative that these receipts prove to be accurate and well coordinated. This is when a custom receipt maker or an online receipt maker can come in handy. These tools assist organizations in compliance and being ready for any audit exercise. Now, what makes fuel receipts relevant for tax issues, and how can they help manage finances?

Why Are Fuel Receipts Necessary for Taxes?

It is an established practice that fuel receipts are used to support tax deductions. Almost every enterprise, especially those in the logistics category, requires vehicles on a daily basis, making fuel one of the big costs. When filing tax returns, most organizations provide fuel receipts to cover such expenses. Therefore, if documentation is not precise, deductions may be refused.

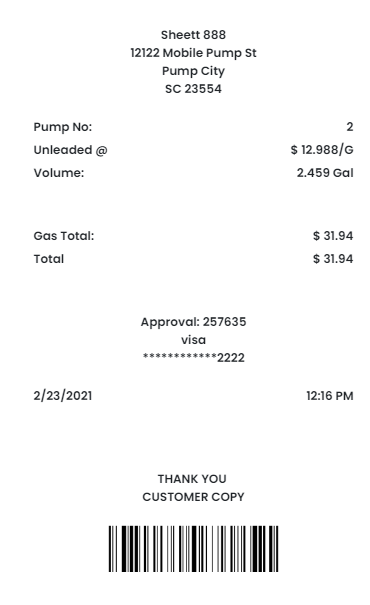

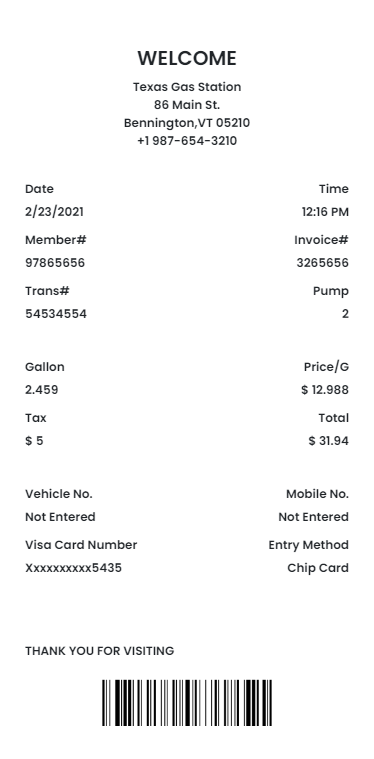

In general, tax authorities need accompanying records. A fuel receipt should contain; the date of purchase, cost incurred, type of fuel and place of purchase. Such information would call for some clarification during an audit, if it was missing or inaccurate. It is always advisable to store receipts in an order and accessible whenever you need them.

How Tools Like Receipt Builder Simplify the Process

Receipt organizing using traditional means can be cumbersome. Tools such as Receipt Builder have been developed to ease this exercise. You can easily create a receipt online and enter the right information. It helps avoid the loss of critical papers and does not let you complicate the task of tracking fuel costs.

Using a cash receipt generator or a free receipt maker online, it is easy to create professional, tax-compliant receipts. This not only saves time but also minimises the occurrence of mistakes. Modern tools even retain these receipts in a digital format so they can be retrieved at any time they are required.

Avoiding Issues with Fake Receipts

Some individuals would prefer to employ a fake receipt maker or even a fake receipt generator in the event that they lose fuel receipts. But if the organization is doing this, it is rather risky and might lead to legal problems. The officers involved in conducting audits of different companies and individuals can be very much rigorous in their work. They can immediately see through what may be fake in fake documents. But it is better to use a reliable custom receipt maker like the Receipt Builder mentioned above.

Clear records portray professionalism and adherence to regulation. As a result, they also shield your business from penalties or audits arising from the lack of or fake receipts. Building trust the right way is always time well spent.

Conclusion

Fuel receipts are a key component of any company’s tax filing process because they must be correct. Thus, Receipt Builder will assist you in keeping all your documentation in check while remaining compliant. For instance, with cash receipt generator or a custom receipt maker you get detailed and accurate record in a few minutes.

Do not lose potential tax deductions because you have no or the wrong receipts. Trust Receipt Builder to assist you in staying on track with your expenses. It doesn’t matter if you are a small business owner or own multiple vehicles; accurate receipts will save you time, stress, and money. Don’t wait to use Receipt Builder for all your receipt requirements. Try it today!

Comments

Post a Comment